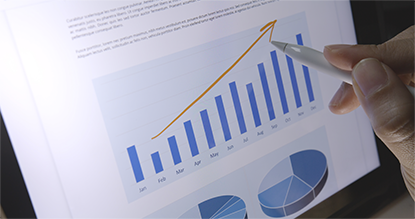

We believe that knowledge is the key to unlocking your full potential in the world of accounting and tax. This is why we offer a range of comprehensive courses designed to equip you with the essential skills and expertise needed to thrive in today's competitive professional landscape.

Our tax returns courses go beyond the basics. We provide you with a deep understanding of both business and individual tax scenarios. From navigating complex deductions and credits to ensuring compliance with the ever-changing tax laws, you'll develop the expertise needed to excel as a tax professional.

View Courses

Equip yourself with the essential knowledge and skills to effectively manage payroll processes. From calculating wages and deductions to ensuring compliance with payroll regulations, you'll learn the intricacies of efficient payroll management.

View Courses

Become an invaluable bookkeeping resource with our comprehensive course. It goes beyond numbers and financial records. You'll learn the essential principles of bookkeeping, including maintaining accurate financial records, analyzing financial statements, and understanding key financial indicators.

View Courses

Gain a deep understanding of sales tax management through our specialized course. You'll learn the ins and outs of sales tax regulations, exemptions, and compliance. The course will empower you with the skills needed to navigate the complexities of this critical business area.

View CoursesWith the growing need for experienced and competent bookkeeping and tax staff, you’re assured of reaching your career goals by enrolling in one of our comprehensive courses.

Our experienced instructors will guide you through practical scenarios, empowering you to apply your knowledge to real-world bookkeeping challenges.

With real-world case studies and practical exercises, you'll gain the confidence to handle all manner of diverse tax problems, providing valuable insights to individuals and businesses alike.

Our hands-on approach and real-world case studies will provide you with practical experience in calculating, reporting, and ensuring sales tax compliance.

Payroll experts with hands-on experience will expertly guide you through the detailed course material.

You’ll gain in-depth knowledge of general tax topics, focusing on key individuals (Form 1040) and tax areas identified by the IRS as priorities (Schedule C & E) for all tax professionals.

It is of the utmost importance that business owners understand not only the profit or loss of their operation but also the status of their assets and liabilities.